An Upward Path

During a recent trip to Austin, I had the opportunity to visit the headquarters for Dimensional Fund Advisors, more formally known as DFA.

For those who aren't familiar with DFA, they are one of the largest mutual fund providers in the world. They also are one of our primary investment providers. If you log into your Schwab or Fidelity accounts, you will likely see an individual investment that starts with the letter D. Those funds are managed by the folks down at DFA.

The DFA headquarters is located roughly 10 miles outside of downtown Austin. The journey from the heart of Austin to the outskirts takes you through the hilly landscapes in the area. When making the drive, you are consistently flowing up and down until you reach their campus. The primary building where the executive and trade teams work is found at the top of a large hill.

As I arrived at the location, I couldn't help but find it funny that the trip to a company specializing in investments was filled with ups and downs and finalized by a sharp upward climb.

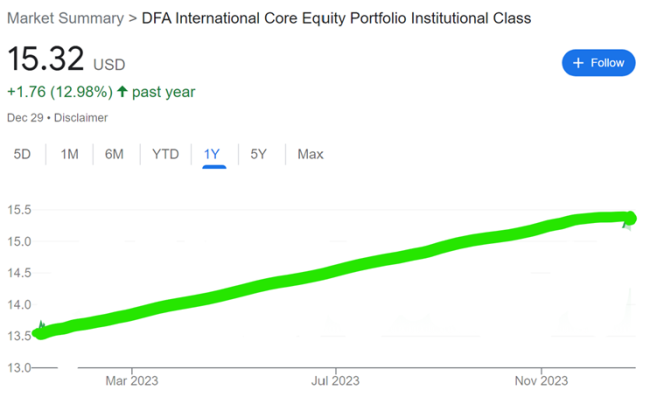

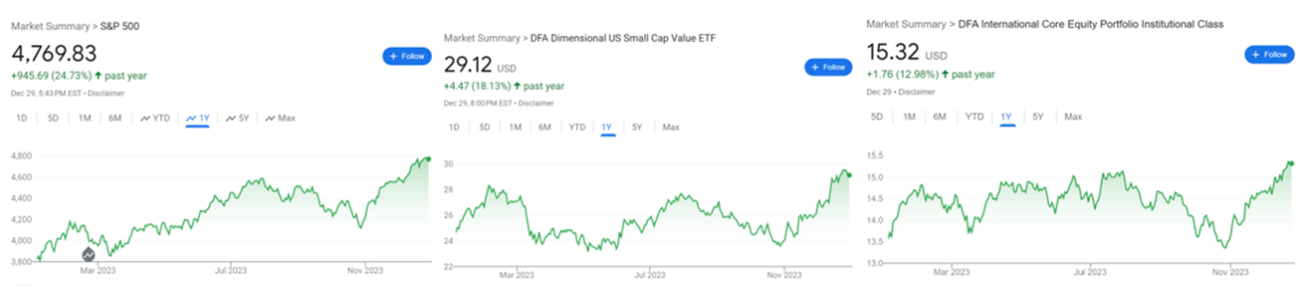

In 2023, equity markets were rewarding to the investors. US markets finished the year up just under 25%...

Smaller companies were also comfortably positive, finish the year up 18%...

Even international companies, which have lagged the US markets for so long, found their footing, finishing the year up in the mid-teens...

If you had shut your eyes on January 1, 2023, and opened them this past Monday, you would have been pleasantly surprised by the end result.

Unfortunately, the returns in markets didn't follow the flat green lines presented above. Instead, they more closely aligned with the path I took to Dimensional. Below are the non-edited versions of the charts shown above. As recently as November 1, the year-to-date returns in most markets were flat.

If you've been with us for a while, you have likely heard us mention that returns often come in bunches. 2023 provided an excellent example of this concept, with most returns coming in the final 60 days of the year.

During meetings over the past few weeks, we've been fielding many questions related to this market surge. Clients, friends, and family members are curious about what caused this spike and whether or not it will last.

Morgan Housel, who has been referenced in many of our previous postings, recently released his new book, Same as Ever. For those who are interested in the actions of the masses, I highly recommend this book.

The below passage really caught my eye…

The core (takeaway) here is that people think they want an accurate view of the future, but what they really crave is certainty.

I don't have an exact stat for this, but I have to imagine that one of the most used words from 2023, and probably back to 2020, is "Uncertainty." If we look at 2023, we had three of the four largest bank failures in history, a debt ceiling that was almost reached, a new war in the Middle East, a government shutdown that keeps getting kicked down the road, higher inflation than the recent past, and higher interest rates.

As much as we crave certainty in our daily lives, markets crave it even more, which makes a lot of sense when you think about it. After all, markets are simply a measure of consumer sentiment. If we, the consumers, feel uncertain, then the markets we participate in will act less confidently.

As we entered the final two months of the year, much of the uncertainty felt in markets started to calm. Banks have seemingly stabilized. The Fed has hinted that the rises in interest rates are likely done, and they may even be pulled back in 2024. The war in Israel is still going on, but it seems to be calming, with troops being withdrawn from the front lines and hostages returning home.

As all of these events have become more certain, markets have risen.

Whenever markets rise or fall in sharp order, we also get inquiries about where things go from here. As always, that's a tough question to answer.

As we move into the new year, things feel stable. However, stability never lasts forever. Carl Richards, a well-known thought leader in the advisory space, is famous for saying, "Risk is what's left over when you've thought of everything."

Unfortunately, we never know what's coming just around the corner. Things like Covid, domestic or international conflicts, business failures, and the one million other considerations can rarely be planned for. And they often happen without any warning.

Oh yeah, and if the TV or radio ads haven't tipped it off, we have an election this year.

As investors, we just have to be aware that these things happen. But we can also take solace in knowing we aren't doing it alone.

As diversified investors, we get the opportunity to purchase a wide array of different companies and assets. These include large companies that we use every day, small companies looking to expand, and companies overseas with goals just like ours in the United States. At the heart of all these companies are people like us, looking to better their outlooks and lives. If you asked me to wager on the thoughts and goals of the masses, I would take it every time.

Rest assured, we continue to maintain a watchful eye over your investments. As markets surged in the last two months of the year, rebalancing happened as needed. A disciplined rebalancing process allows us to capture some of the winnings your accounts saw and preserve them in safer asset classes. For our retired clients taking distributions, these winnings will help fund your cash flow heading into 2024. For our clients who are still saving, you now have more dry powder available if markets pull back.

Where things go from here is anybody's guess. However, we internally have a lot of positive feelings for markets moving forward. 2023 was a good year, and we are hopeful that 2024 will yield much of the same.