A Summer of Optimism

Today I am writing from a small coffee shop near Lincoln Park in Chicago. For the past couple of hours, I have watched as people wander in and out. A sunny morning has brought a crowd of people with very relaxed demeanors. Nobody is screaming into their phones, in a hurry to get somewhere, or even a scowl at the person next to them. All in all, it's a very calming setting.

For the first time in a long time, the financial world has a similar calming sense. The past three years have brought the highest inflation in 50 years, the fastest interest rate hikes in history, and stock markets that have bounced around within a wide band.

The start of the year offered a continuation of these trends. Between the banking failures in March and the debt ceiling drama in May, the beginning of 2023 offered its own moments of panic.

However, as we enter the first few days of the summer season, the headlines centered around the financial world feel rather tame.

The month of June has been welcoming to investors. Between the debt ceiling being ironed out, improved economic data, and a pause in interest rate hikes, stock markets have had a pretty solid rally.

We seemingly mention this in every article, but the idea of market returns coming in bunches was proven in early June. The first two weeks of June saw the S&P 500 rise by 5%.

Going even deeper, the first week of June saw US Small Cap Value positions increase by almost 9%. That's right, a 9% return over five days of trading.

This rally in Small Cap Value, in particular, feels long overdue. These positions had a solid start to the year and were up as much as 14% in early February. Unfortunately, the month of March was unkind.

Small Cap Value positions tend to have larger exposures to financials and banks. For example, the position above, Avantis US Small Cap Value, a fund we hold in many of our portfolios, has 25% of its fund invested in financial companies. These companies were negatively impacted when the banking issues were being worked out in March.

One of the driving reasons behind the poor performance of financial stocks was the rapid rise in interest rates. When the Fed increased rates, the bank's long-term holdings lost value. In prior periods of rate increases, the pace at which rates rose was much slower. When the Fed went pedal to the metal this time, the on-paper losses were much faster and deeper.

Bank failures are never good, and the level of concern people felt during this period was warranted. But there are a few silver linings that came from this. The first is that FDIC insurance does work. Not a single dollar of depositor money was lost when the banks failed. The only people who lost money were the shareholders in each bank's stock.

The second silver lining is it caused the Fed to take stock of its decision-making and realize the unintended consequences it may have.

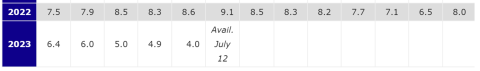

For the first time since early-2022, the Fed decided to tap the brakes on interest rate increases this past week. A battle was won in the war against inflation when the June reading came in at a lower-than-expected rate of 4%. The table below provides the monthly inflation readings, which have steadily decreased since December 2022.

When the Fed started this quest to tame inflation, it set a target goal of 3%. As we inch closer and closer to that number, the hope is that the Fed will start to slow, or even stop, the interest rate increases.

If/when we finally get to a point where interest rate increases slowly, the hope is that markets will rally. And from a fundamental standpoint, there is a lot of upside to be realized.

Among his many words of wisdom, Warren Buffett is famous for noting that valuations are the closest thing we have to gravity in financial markets. The idea behind this is that the valuations of companies may differ in short-term periods, but eventually, there is a reversion to the mean.

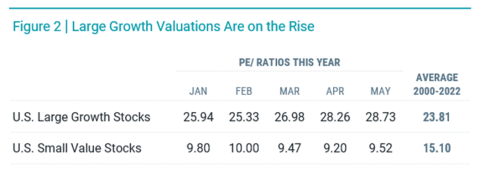

The best measure of a company's valuation is its price-to-earnings ratio (P/E ratio). This economic data point compares how much a company's stock price is worth compared to its revenue. A low P/E ratio hints that a company is undervalued compared to its earnings, and a high P/E ratio indicates that a company is overvalued.

The chart below highlights the P/E ratio of Large Growth and Small Value stocks and compares them to historical averages over the last 22 years.

The current P/E ratio of Small Value stocks is well under its historical averages, which hints that those positions are being undervalued. As you've met with us in the past couple of years, you have likely heard us reference a feeling of a coiled spring. The idea is that the reversion to the mean will happen at some point, and the pop that comes with it will feel similar to when a spring is sprung. This reversion should result in positive performance for Small Value positions, which would be a welcome sign for our portfolios.

Unfortunately, the timeline for when this will happen is still tey to be determined. That's the tricky part about being an investor. Additionally, when this spring comes, it may occur in a short period of time. We saw this to start the month of June, and it could happen again in the coming months. On the other hand, it could also take much longer.

This is the main reason that we diversify. We know at some point, each asset class will provide outsized performance, and other positions will lag. However, as long as we maintain exposure to each asset class, there should always be something helping your money grow. If everything goes in the same direction at one time, either up or down, you are not diversified.

Over long periods, we know that investing provides a benefit. Unfortunately, we live in the short term, and finding short-term hope over the last few years has been tough. However, for the first time in a while, we are starting to feel optimistic about markets heading into the back half of the year. If inflation keeps coming down and the rise in interest rates slows or stops, we may start seeing more positive market performance. This presence of hope is offering a calming feeling that we are welcoming with open arms.

As always, if you have any questions, please don't hesitate to reach out. Otherwise, we hope you have a great summer!