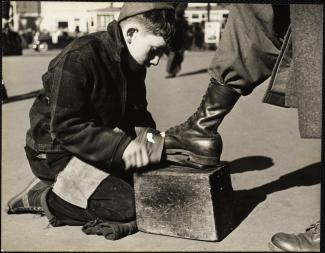

An Ode to the Shoeshine Boy

One of my favorite stories of wealth creation is that of the Kennedy family.

In 1929, at the height of an economic boom in America, Joseph Kennedy Sr. (father of JFK) was working as a stockbroker on Wall Street. As the story goes, Joseph was walking around when he decided to sit down for a shoeshine. While polishing his shoes, the young worker gave Joseph some of his favorite stock picks. When Joseph heard the shoeshine boy giving out stock tips, he figured the party was about to end, and it was time to get out of the market. Joseph proceeded to exit his positions in the market and bought short positions that bet on the market going down.

Shortly after that, the stock market entered a free fall. On Monday, October 28, 1929, the market dropped about 13%. The next day it fell another 12%. These became better known as Black Monday and Black Tuesday, and ushered the United States into The Great Depression.

Now did Joseph profit from this type of bet? Absolutely. It's estimated that he made somewhere north of $150 million during that period, which equates to roughly $3.5 billion in today’s dollars.

Did he make these bets based on the shoeshine boy? Probably not, but it makes for a good narrative.

Stories like this are great because they show that although society has progressed incredibly quickly, the human element of investing and speculating will always be around.

2020 was a year that was dominated by COVID. Days consisted of learning to work remotely, helping kids with homeschooling, and trying to digest the news that was coming out surrounding the pandemic. Outside of that, there was little time to do anything else. The vast majority of our country was quickly shifted home and forced to create a new "normal."

However, by 2021 there was a shift. At this point, kids were back in school, and vaccine distribution had begun. Additionally, remote work had become much more comfortable and routine. All of a sudden, there was more time available during the day to allocate to other things. One of the big things during this time was investing.

2021 was one of the most bizarre years the financial world has ever seen. Between Gamestop and AMC short squeezes, the rise of NFTs (a picture of a rock sold for over $1mm), and Bitcoin doubling in value, there was no shortage of headlines depicting people making money with ease.

FOMO, or the fear of missing out, is a real thing. This is especially true when it relates to money. When we see headlines of people making large sums of money without much effort, it creates an innate itch. And when that itch pesters too much, you scratch it.

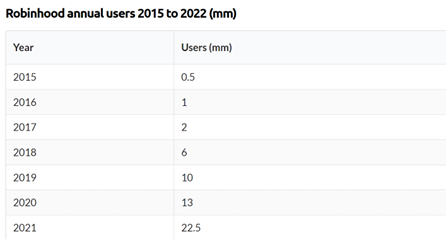

It’s estimated that 10 million brokerage accounts were opened in the United States in 2020. In 2021 Robinhood, a platform that only offers brokerage accounts, had 9.5 million new accounts on its own! That doesn’t include platforms such as Fidelity, Schwab, Vanguard, TD Ameritrade, and the dozen or so other brokerage options available.

Between conversations on a bar stool, overhearing groups of people on the street, or even talking to parents at a soccer game, it was nearly impossible to avoid hearing about someone’s favorite stock picks. For some people, the stock market became the new Vegas.

One of the primary reasons for the individual stock trading was that 2021 was a great year for markets. As measured by the S&P 500, the U.S. stock market had a 27% gain for the calendar year. Foreign markets were also positive, returning roughly 11%. In fact, the only asset class that posted a negative year was emerging markets, which had a 3% decline.

When people see their money rise, they get excited and think they've figured out the winning formula. There is a belief that the rise will continue and that all it will take is to find the next Amazon or Apple. Start-up companies knew this, which is why there was a considerable spike in Initial Public Offerings (IPOs). In a typical year, 200-250 companies go public. 2021 saw over 1,000!

The vast majority of these newly public companies were household names. The Honest Company (Jessica Alba’s company), Legal Zoom, Clear (airport security), Robinhood, and a handful of others saw the public markets for the first time in 2021. There are two other things that the companies listed above have in common. The first is that they have yet to produce a penny in profit. The second is that they are all down considerably from their price at IPO, and there's no guarantee they will ever return to that initial price point.

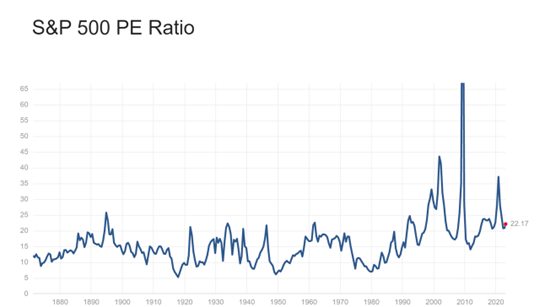

If you’ve worked with us for a while, or have read some of our previous postings, you have probably heard us say that valuations are the closest thing we have to gravity in financial markets. The price-to-earnings ratio (P/E) measures how much a company’s stock price is worth relative to how much the company earns. Put more simply, the higher the P/E ratio, the more overvalued a company is compared to the revenue it produces.

The chart below shows the P/E ratio of the S&P 500 over the past 150 years. As we can see, the P/E ratio in 2020 and 2021 was the third highest it has ever been. Theoretically and historically, a P/E ratio of that level is unsustainable over long periods. Either the earnings that companies produce had to rise by a larger-than-normal amount, or the companies' prices had to come back down.

Unfortunately for investors, the reversion to the mean resulted in decreased stock prices.

Saying that 2022 was a negative year is an easy and honest thing to do. But some context needs to be added to help paint the complete picture.

Last month we wrote about some factors that brought down stock prices, the primary one being the rapid rise in interest rates. It may sound like a very obvious statement, but companies that carry a lot of debt are much more affected by an increase in interest rates than companies with lower debt levels. And can you guess which companies tend to carry the most debt? You would be correct if you guessed the very growth-oriented companies, such as the IPO and tech stocks mentioned above.

When interest rates rise, these companies have a much higher level of debt to service on an ongoing basis. When servicing debt becomes a more significant part of the budget, a company has to accept lower earnings or make cuts in other areas. Unfortunately, we've seen both of these, with tech companies cutting jobs and their stock prices falling drastically.

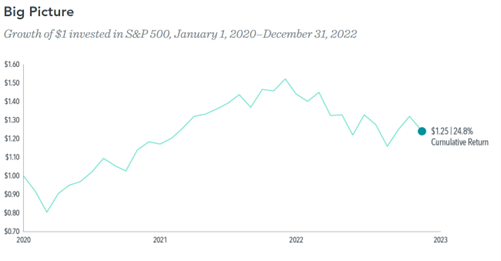

Despite these grim details, the S&P 500 is still performing to its historical norms. If we look at the period of 2020-2022 the S&P 500 had a total return of about 25%, or about 8% on an annual basis.

This performance occurred during a period that saw a global pandemic, a presidential election, a war involving Russia, and about 1,000 other things that have influenced markets. If you had told me in January 2020 that all of this would happen and that the U.S. market would return an annualized 8% per year, I would have said you were nuts.

Getting caught up in the day-to-day rumblings you hear regarding financial markets can be very easy. Between people bringing them up in casual conversations, social media, and the seemingly endless news coverage, it's nearly impossible to avoid hearing about something you might miss out on. However, markets don’t operate on those individual variables alone. Trillions of dollars and data points trade hands globally daily, and everything you or I know has already been accounted for. You may hear about certain oddities in the financial world, but they rarely last long. Further, by the time you've heard about them, it's probably too late, and being late often results in negative consequences.

As asset allocators, not stock pickers, we strive to give ourselves the best chance to win. This means allocating dollars around the globe, investing in certain value sectors that have historically performed well, mitigating risk with high-quality bonds, and ensuring we maintain a disciplined plan for rebalancing. We are aware that these things will come up, but we also know that our investment strategy has been time-tested over nearly 100 years. We are confident in this strategy and still believe it will provide us with the best results moving forward. We'll let the shoeshine boy speculate with his money while we make sure to give your money the best care we can.