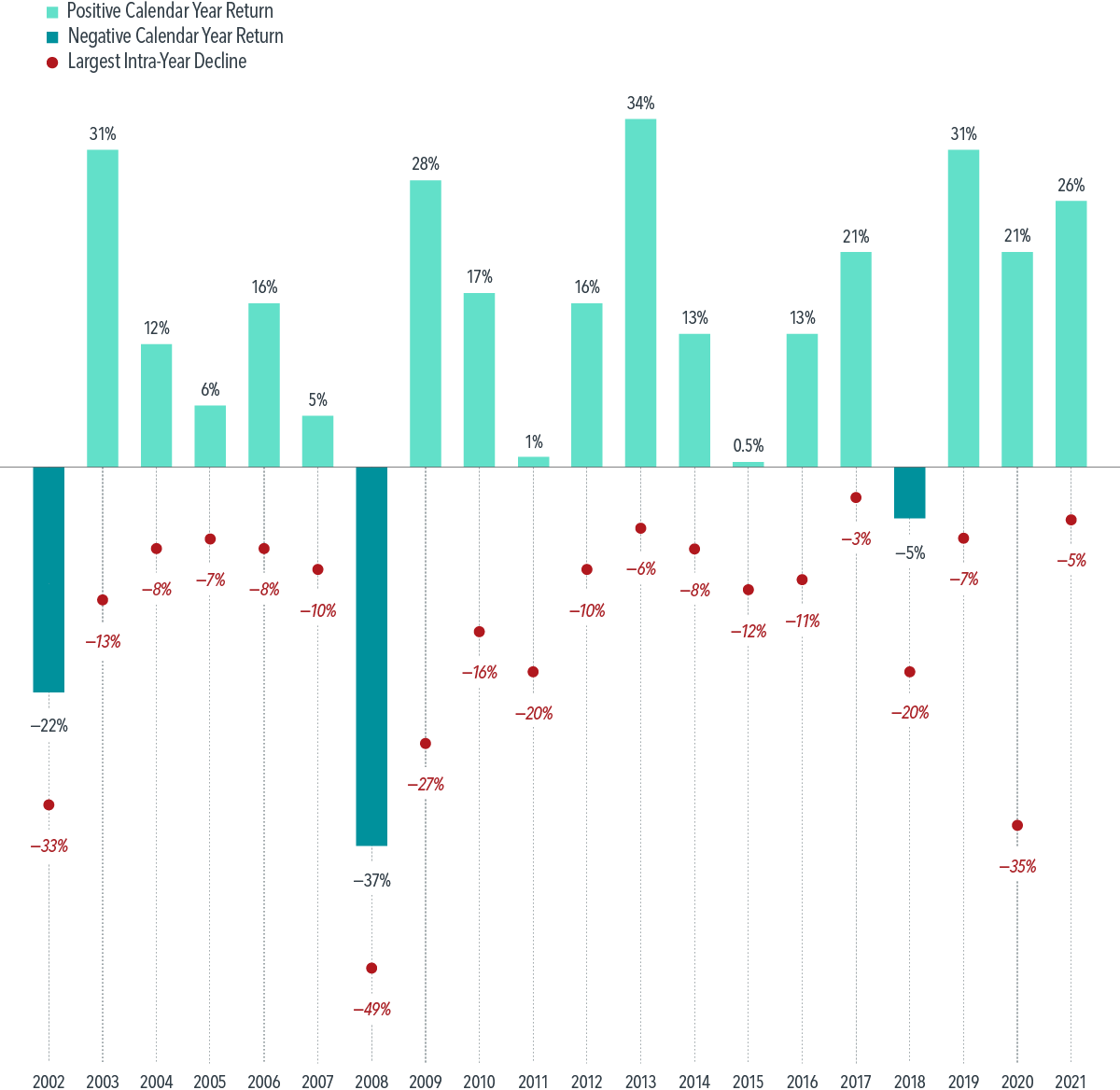

Do Downturns Lead to Down Years?

Stock market slides over a few days or months may lead investors to anticipate a down year. But a broad US market index had positive returns in 17 of the past 20 calendar years, despite some notable dips in many of those years.

Volatility is a normal part of investing. Sharp downturns happen with a high degree of requency and are part of the investment experience.

The number and severity of dowturns in this chart since 2008 tend to surprise people, particularly after a terrific overall run for US stocks since that time.

We quickly forget the storm after the skies are clear, but it is a good reminder that they come and go like the weather. Like any natural storm, preparedness and precautions must be in place before it arrives. In the investment realm, this refers to having appropriate asset allocations / risk profiles, having access to cash outside of the market for spending needs, and sticking with a disciplined approach that has weathered these before.