Coronavirus, Past Epidemics, and Markets

The current coronavirus breakout seems to be on everyone’s minds, and rightfully so. As the number of infected people continues to grow, so might some of our anxiety about the spread and potential impact of the virus. While we don’t know how many people the virus will infect and the length of this viral cycle, we do know that you may have some questions about how this might impact your investments.

With that, we want to share three investment-related themes to keep in mind. First, don’t give in to the urge to take action. The news stories about the virus can be downright scary, but we need to remember that market prices react immediately to both good and bad information. To potentially make money or avoid potential losses, we would need to trade before it is news. And, of course, we don’t know the future, so any action would be a guess, and therefore, any positive result would be luck.

Second, we need to keep perspective. This isn’t the first new virus we’ve seen, and this won’t be the last. SARS, Zika, H1N1 and others have all come and gone. While the concerns at the time were the same (e.g., How quickly will it spread? Will there be a cure? Will it slow down the global economy? Will it impact my investments?), our society has figured out how to overcome past viruses, and markets have done the same.In fact, markets have short memories regarding epidemics.

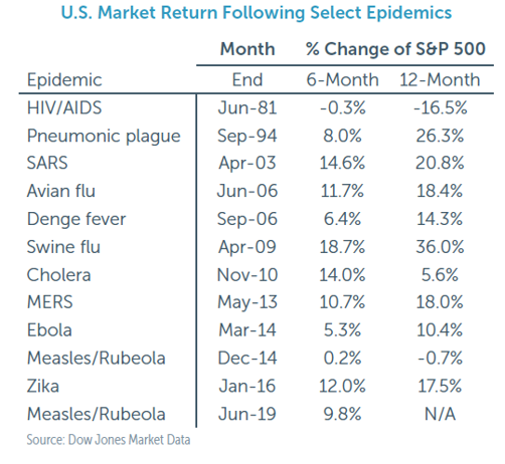

Markets may initially react to the uncertainty and fear that comes with any new concern, but, for the most part, viruses eventually get contained and investors return to corporate and economic fundamentals. We can see this pattern in the above table.

Market returns generally have been up in the six- and 12-month periods following the outbreak of a virus or disease. While this is a small sample set, we know that keeping focused on the long-term helps us keep a level head during all kinds of storms.

The third and final idea we want to share is to be on alert. Believe it or not, the Securities and Exchange Commission had to issue a public warning that fraudsters are attempting to play into our natural emotions of fear and greed during this period of uncertainty. There have been reports of social media posts and online ads promising a huge profit by investing in companies that have supposedly found a cure for the coronavirus. As we all know by now, there are no sure things or get-rich-quick strategies when it comes to investing.

Our advice remains the same, to stick to your long-term plan and tune out the noise. We invest client money in a way that isn’t dependent on lucky guesses or get-rich-quick schemes. We use investment strategies and prepare financial plans that assume events like these will come and go. So, please, stay positive and focus on your family and your health.

We are monitoring this situation (amongst many others) and will be sure to keep you up to speed on our thoughts and developments.