Almost Back

For those who don't know me well, I am a college football junkie. This is mainly due to decades of relative success from my Alma Mater, the Wisconsin Badgers. I'm sure some of our local Minnesota fans will be quick to humble me on that comment.

Around mid-July of each year, my friends, family, and even co-workers start to hear me talk about the return of college football. This was especially true during my university days when the return of Saturday gamedays coincided with the return to being with friends and classmates.

Even though gamedays in college look quite a bit different than they do today, the countdown to college games being back has continued. Along with this come the conversations with those close to me about what the season outlook is going to be and the seemingly slow tick to the first kickoff. Unfortunately, I'm not the most patient person on earth.

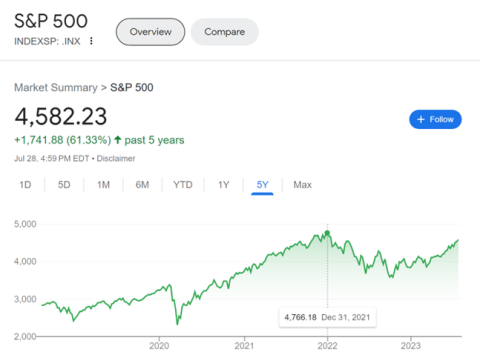

Although no client has explicitly stated it, it would be reasonable for there to be similar anticipation of markets returning to their peaks. The last time the S&P 500 closed at an all-time high was January 3, 2022. Since then, we've seen almost 19 months of drawdown. The conversations we've been having with clients have primarily centered around maintaining discipline, with the knowledge that, at some point, there would be a market recovery.

We were roughly 15% away from new all-time highs when we wrote to you in April. As I sit here writing today, that number has pinched to 4%. Another good week or two and we may well be there.

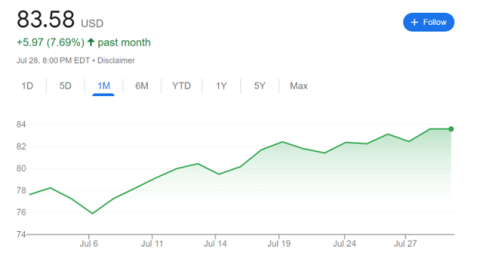

Going even deeper, smaller companies and value positions are already back to their peaks, largely thanks to an almost 8% appreciation in July.

Investing at all-time highs can be an intimidating thing to do. We, along with the vast majority of the investing world, always promote the practice of buying low and selling high. When all-time highs appear, these basic principles would seem to imply that we should be selling. Unfortunately, things aren't that simple.

Although his article is a bit dated, Ben Carlson did a deep dive into all-time highs in late-2020. His research found that markets tend to be at an all-time high, around 7% of all trading days. This would translate to 17 days of trading at all-time highs in an average year.

Now averages are a little tricky to work with. Below are the number of highs we saw in the market over the past few years…

- 2020 – 32 (13% of trading days)

- 2021 – 70 (28% of trading days)

- 2022 – 1 (.4% of trading days)

On a year-to-year basis, the number of all-time highs will differ. However, there is a strong precedent that once we see a new all-time high, additional highs tend to follow.

Over the past few months, we've provided a more optimistic short-term look at markets. Much of this optimism stems from the same economic concepts we dealt with last year, just in a different light.

The Fed continues to have inflation pegged as enemy number one, which led to yet another rise in their target interest rate this past week. During his press conference, Chairman Jerome Powell reiterated that they would continue to enact economic policy until inflation reaches the Fed's 2% target. With the most recent inflation coming in at 3%, it's not unreasonable to think the Fed may raise rates again during the 2023 calendar year.

One of the hardest things for investors to do is separate investing from economics. Basic financial principles and classes almost always group these two together, which is not inherently incorrect. What is important to remember is that these two work on very different timelines.

When it comes to financial data, everything is reported on a backwards-looking basis. The inflation data that comes out each month compares what prices are today to what they were 12 months ago. GDP, which measures how much the value of our goods and services has grown or decreased, is always reported for the prior quarter.

On the flip side, investing is a forward-looking exercise. In general, markets are always trying to look at what things will look like beyond 6-months from now. If they deem the future outlook positive, then the performance of the underlying stocks should improve.

That said, a lot of the appreciation we've seen in the past couple of months is due to a positive forward outlook. Yes, the Fed may raise rates again when they meet in September. But markets already know this is a possibility. Trillions of dollars are traded hands on a day-to-day basis, along with trillions of pieces of information. The vast majority of the time, when economic policy is enacted, markets have already been preparing for it.

As we head into the Fall months, we continue to have a high degree of faith in the investment philosophy. As allocation levels dictate, rebalancing is happening. When cash needs arise, they come from the most appreciated and tax-efficient assets. Consistency and diversification is still the driving force behind a successful investment performance. We have been really happy with how things have been going this year and are hopeful these trends will continue.

Please don't hesitate to reach out with any questions or concerns.